- #Quicken for multiple users cor windows and mac install

- #Quicken for multiple users cor windows and mac Patch

- #Quicken for multiple users cor windows and mac software

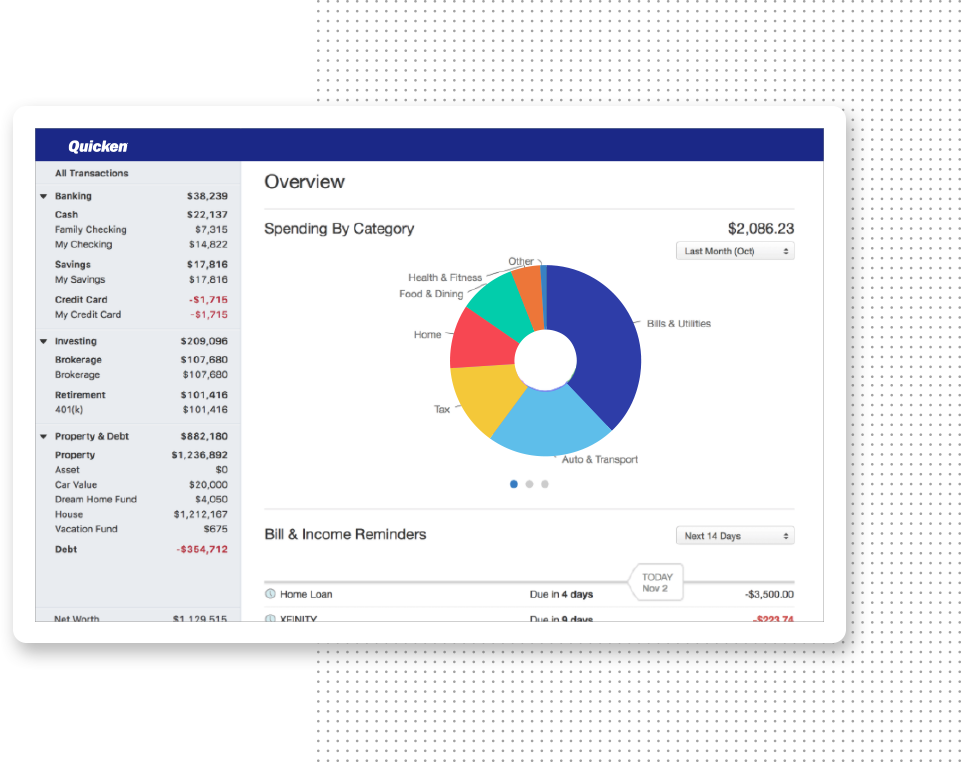

Exemplified by Mvelopes and YNAB, zero-based budgeting (aka the envelope method) requires you to cover every expense, including savings, by a source of income. Of course, existing on less income (and thereby having a lower standard of living) is easier said than done. Research by Nobel Prize-winning economist Richard Thaler found that you’re more likely to reach your goals if you take decision-making out of it and automate your savings. By tucking away, say, 10% of your income in a high-yield savings account automatically, you’ll prime yourself to live within your means using the rest of your income. This is the belief that you should contribute to your own savings before you commit yourself to anything else. Building savings into your monthly spending plan can help you make progress toward this important goal. To put into perspective how long it might take to accumulate that much money, an old financial saw says you should be able to save up for a down payment on a home over two to three years. (You want the money in a savings account to make it easier and cheaper to access quickly.) This is a particularly difficult task to accomplish: In a 2018 Wells Fargo/Gallup Investor and Retirement Optimism Index survey, less than 40% of investors said they had enough savings to replace three or more months of income in an emergency. Spending less than you earn can also help you ratchet up your emergency fund-a pool of money, equal to three to six months’ worth of essential expenses, that sits in a savings account in case some unforeseen cost arises. After all, money is fungible: What difference does it make if you spend, say, $500 on groceries and $500 on dining out, as long as you arrive at the end of the month having shelled out less than you earned? Still, some may find categorizing expenses a helpful guardrail to stay on track and increase their savings. It is a little strange, though, when you take a step back. You divide your spending into different buckets and draw down on those buckets for the month until you get to zero. This is the hallmark of both Mvelopes and YNAB. Keeping tabs on what you actually spend will help you not only stay within the current month’s budget but also adjust your assumptions for next month’s. This was the service Mint so uniquely supplied when it launched back in 2006. As Olen points out, this can be tricky for some, but less so if you earn an income via a regular W-2.

You need to have a guess as to how much you’ll earn to know how much you can spend. If you forget, you may have some trouble.

#Quicken for multiple users cor windows and mac install

Don't open the program and use the automatic update feature rather, manually install the Mondo patch. Before you do anything else-before you even open the Quicken program the first time-you must install the Mondo patch.

#Quicken for multiple users cor windows and mac Patch

If you're installing Quicken 2017 to upgrade from an older version, don't forget to go to the Quicken support site and download and install the Mondo patch update.

From time to time, people report trouble when upgrading to a newer version, but that's only because they forget about one crucial step: the Mondo patch. Installation was a breeze-very quick and not a single problem. That's a LOT cheaper than a subscription!

#Quicken for multiple users cor windows and mac software

For thirty bucks, I got a fully licensed (LEGAL!) copy of the software that will be supported through April 30, 2020. However, I'm not crazy about subscription software, so I bought this to lock in an extra year of support before being forced to pay through the nose for a subscription. Intuit had neglected its Quicken line for several years before selling it, and while it remains to be seen what the new owners do in the long term, Quicken remains the best option in personal finance software. I use the Home & Business version so I can track my income and expenses from freelancing, and it makes bookkeeping a lot easier. I've used Quicken since the days of MS-DOS, and it's still the best of the best. Still the best personal finance software extant!

0 kommentar(er)

0 kommentar(er)